Two More Errors Found in 2017 Child Support Guidelines

After publishing yesterday’s post about an error we found in the 2017 auto-calculations, we heard from other attorneys about two other problems with the 2017 guidelines calculations. These errors are, in fact, more serious as they aren’t merely a problem with the way a worksheet translates the calculations, they’re problems with the formula for calculation themselves.

The first, along with examples highlighting the issue, was brought to our attention courtesy of Justin Kelsey of Skylark Law & Mediation. This error results in a payor paying more child support for fewer children based on the way support is calculated for emancipated versus unemancipated children.

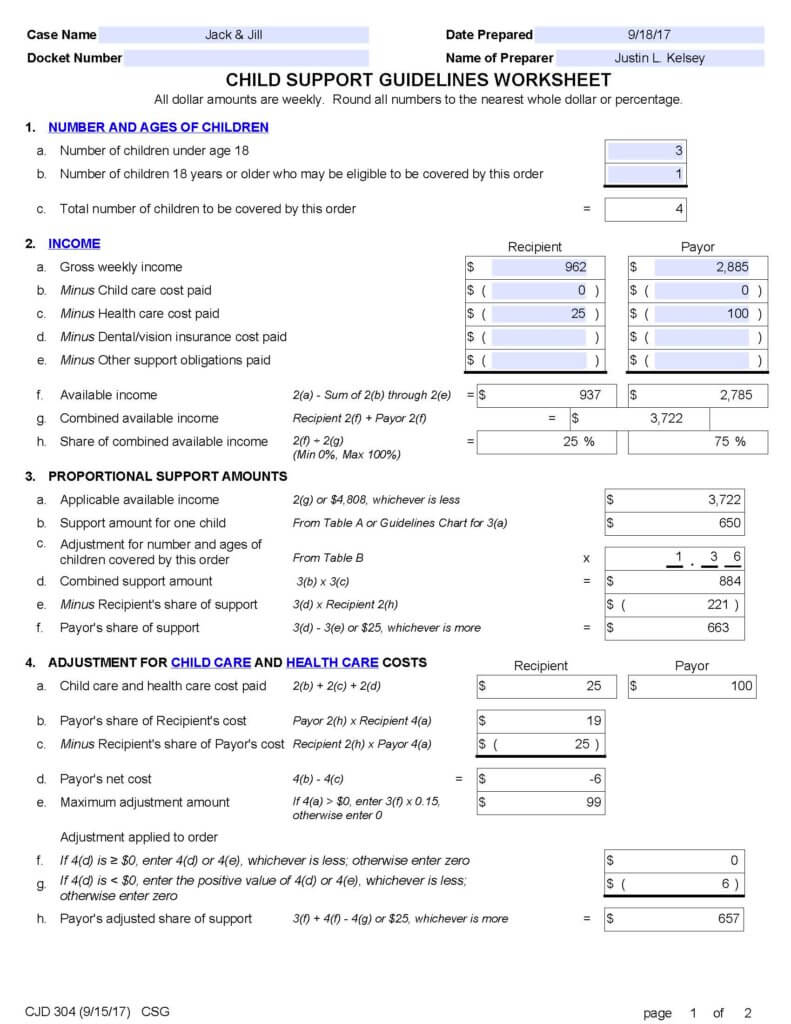

Take the below example where Jill is paying Jack child support for 3 children under the age of 18 and 1 child who’s in college (over 18 years old but not yet emancipated). As you can see, she’s paying child support in the amount of $657/week in child support to Jack for 4 children total.

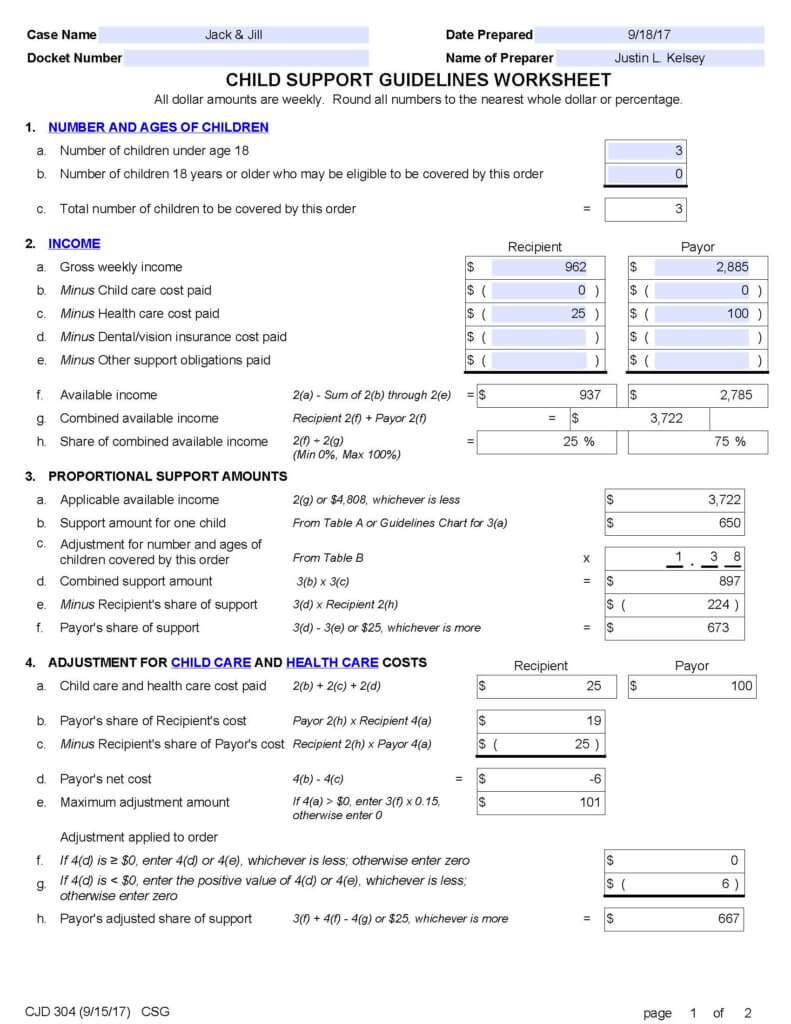

Now what happens when the college child graduates and s/he is emancipated? Jill pays child support for only 3 children. Take a look at the new calculations below and you’ll notice that Jill is now paying $667/week for 3 children.

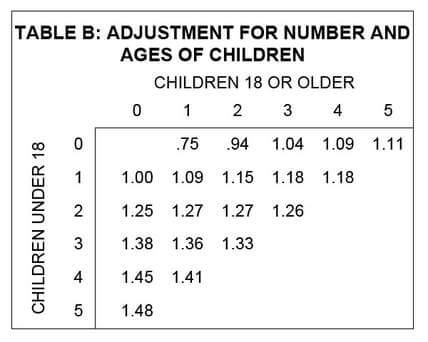

Jill is therefore, under the new Guidelines, paying more child support for fewer children. This error is due to a multiplier error in Table B of the Guidelines.

As you can see, the first row and column are correct because as you go right and down, the multiplier increases. This makes sense because the more children you have, the more child support should be paid. The figures start to go awry when you look at the numbers in the middle. For example, row 3 has multipliers decreasing with each additional children, meaning your child support would decrease the more children you have. This simply does not make sense.

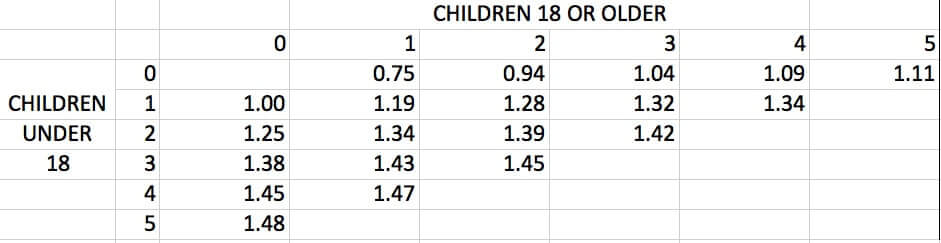

The below corrected Table B is courtesy of Professor Benjamin Bailey and his wife, Attorney Julia Rueschemeyer:

As you can see, this table makes more logical and mathematical sense since all the numbers are increasing from left to right and top to bottom.

Hopefully the Probate and Family Court sees fit to correct this error as soon as possible.

The second error involves the adjustment for child care and health care costs. The new 2017 guidelines don’t seem to account for situations where parents share equal or nearly equal parenting time, as outlined by Jason V. Owens of Lynch & Owens.

Here’s the problem: When medical and child care credits are calculated using this method, the same parent receives the credit twice. If the 2017 Guidelines give one parent a $30 credit for his or her child care costs, then calculating the Guidelines twice for shared custody means that the parent will receive the $30 credit in both calculations, resulting in a total credit of $60 for that parent.

As outlined in Jason’s detailed blog post, the current guidelines result in grossly inflated credits in Section 4 of the calculation when applied to situations where parents share custody. Another scenario that appears to have not been contemplated despite such parenting schedules being increasingly common.

The Infinity Law Group 2018 Massachusetts Child Support Calculator has been updated and delivers correct information.

Infinity Law Group LLC

Infinity Law Group LLC